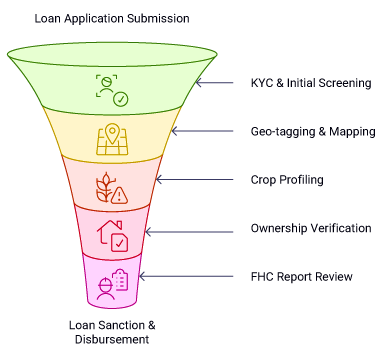

As an underwriter or credit manager, your decision is only as strong as the data you have. In rural lending, you often face incomplete borrower claims, delayed ground reports, and limited visibility into farm health — increasing the risk of delays or defaults. You need clear, verified intelligence at the right time — whether assessing a new loan application or renewing an existing one.

Our Solution – From First Sanction to Final Renewal

ADL’s Agri-Credit Solution, powered by the REAL platform,

is designed to give you field-level clarity and confidence

at every stage of the loan

lifecycle.

It delivers tools that fit seamlessly into your credit workflow:

- See the borrower’s farm as it is today — geo-tagged, mapped to verified survey boundaries.

- Get accurate cropping details — type, acreage, sowing date, growth stage, and quality.

- Access ownership & administrative data instantly — no waiting for physical verification.

- Receive a comprehensive Farm Health Card report or pull data directly into your system via API.

Impact:

-

Approve Faster

Approve Faster

-

Spot Misrepresentations

Spot Misrepresentations

-

Reduce Field Visits

Reduce Field Visits

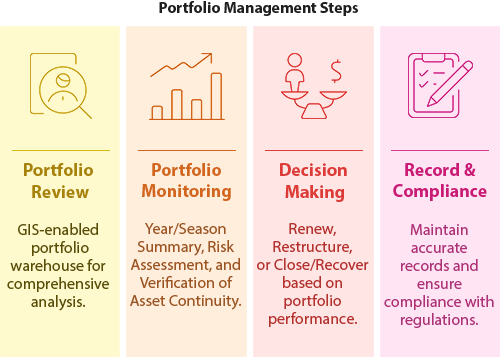

At renewal, this is supported by REAL – Portfolio Monitoring reports, providing:

- Year/Season Summary – Full farm performance across the credit cycle.

- Risk Assessment – Flags underperforming or distressed borrowers.

- Asset Verification – Confirms ongoing control of verified farm assets

Agri Credit:

-

Renew

Renew

-

Restructure

Restructure

-

Recover

Recover